do pastors pay taxes on their homes

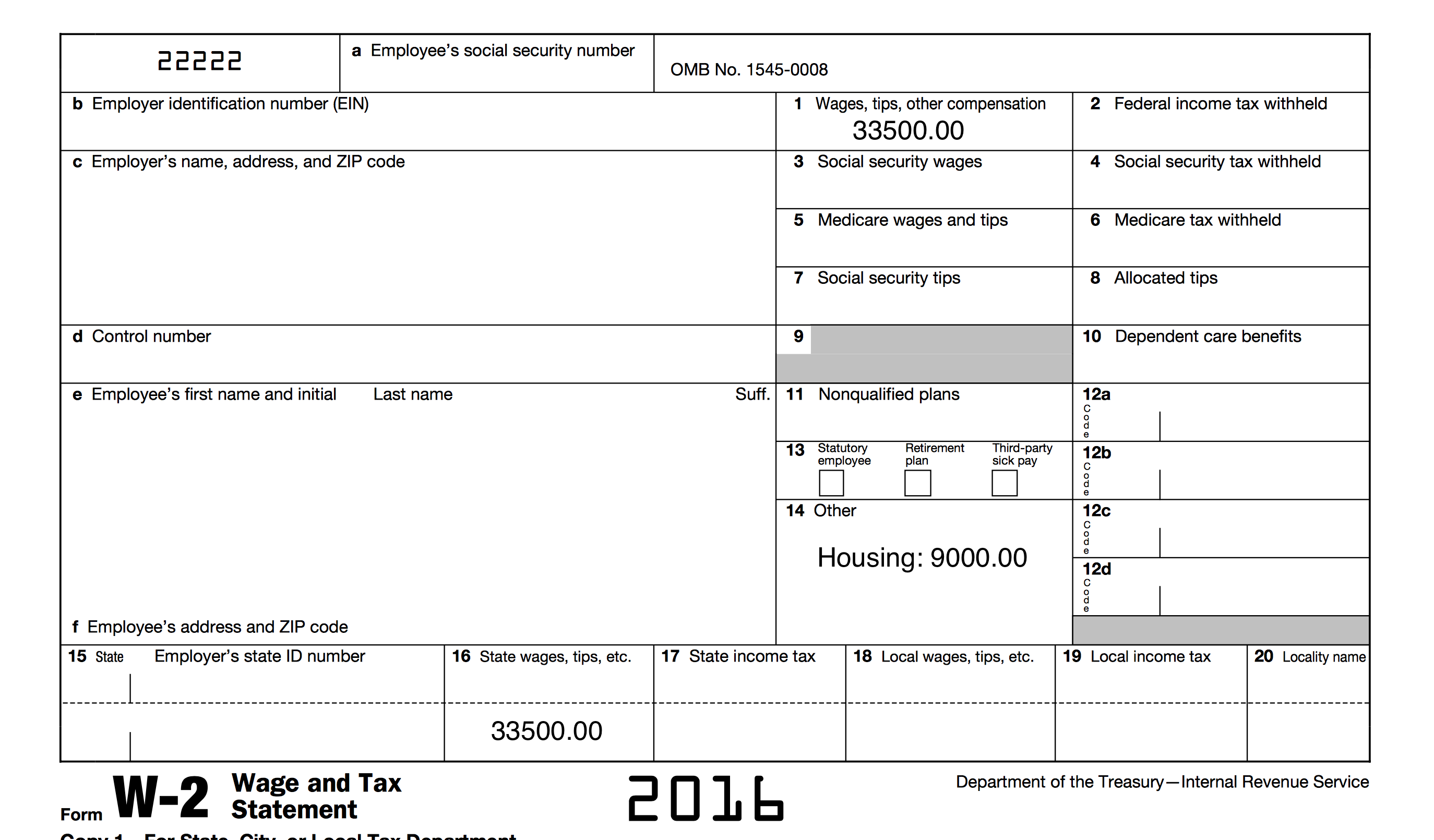

It can be confusing especially for those who are new pastors or those who are new to this allowance. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount.

Clergy Tax Guide Howstuffworks

Legally a lot of pastors dont report everything they are supposed to.

. If the minister receives a cash housing allowance and purchases a home the minister will pay the mortgage payments with tax-free income yet can deduct real estate taxes and mortgage interest. Million Dollar Homes of Texas Ministry Leaders Scrutinized for Tax-Exempt Status. By the early 20th century though both clergy housing and taxation had changed considerably.

That being said you will want to set it up as a designation of salary as opposed to an additional form of compensation. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. If a pastor receives free housing referred to as a parsonage allowance or a housing allowance from your church that is specifically designated as such its usually exempt from income taxes.

The IRS allows a ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance. But for a pastor there are two sides to taxesthe federal and the SECA. Housing allowance amounts are not taxable on your income tax but are subject to taxation under self-employment laws.

The pastor can use the tax-free housing allowance to make mortgage payments on a home and then write those payments off as well. Housing was thus a form of non-cash payment that was exempt from taxation since the parsonage was church property. Housing allowance isnt an actual form of salary given to pastors but instead its an exclusion of taxes based on your housing expenses.

But yes they pay income taxes in the US. Hilliard and his wife live on part of the property but a church attorney says the rest is a. So if a pastor designates 50k as housing allowance but only spends 20k on his housing then he does pay income tax on that other 30k and will probably be fined by the IRS for not withholding enough to begin withso Ive heard.

If your housing is worth 700 per month that must be clearly stated to prevent claiming more on the tax exclusion. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Ministers housing expenses are not subject to federal income tax or state tax.

Since 1943 Murdock v. Pastors do not pay income tax on the amount that they actually spend on their housing. Generally those expenses include rent mortgage interest utilities and other expenses directly relating to providing a home.

You cant be allotted 800 tax-free if your cost of living is only 700. In about 15 states parsonages are exempt from property taxes. The amount excluded cant be more than reasonable compensation for the ministers services.

The housing allowance will allow you to reduce your federal taxes by the amount of your allowance and thus reduce your federal taxable income. If the pastor continues to live in the home it becomes in effect a church-owned parsonage. FICASECA Payroll Taxes.

10 Housing Allowance For Pastors Tips 1. 60 If the minister later sells the home at a loss like all taxpayers the minister may not deduct the loss. A Local 10 investigation found pastors living in multi-million dollar homes exempt from paying property taxes -- because their homes are owned by churches.

Still ministers have tried to argue against this ruling for decades. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. Of course your church must allot a set fair amount for your housing costs.

A Local 10 investigation found pastors living in multi-million dollar homes exempt from paying property taxes -- because their homes are owned by churches. Instead clergy can pay income taxes in quarterly installments throughout the year. 105 the United States Supreme Court has ruled that the First Amendment guaranty of religious freedom is not violated by subjecting ministers to the federal income tax.

But once they opt out they can never opt back in and can never receive social security benefits. 61 However ministers and other taxpayers. If the church pays relocation fees this is considered taxable income.

If that is the case the church should withhold income taxes only not Social Security taxes which you must pay quarterly throughout the year. In Harris County New Light Church World Outreach Worship Center receives a tax break of about 100000 per year on a 25000-square-foot lakeside mansion. Ministers are not exempt from paying federal income taxes.

Read on for more detail on the housing allowance for pastors and how to record it for tax purposes. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. If a religious organization provides a home also referred to as a parsonage for a minister the cost or value of the home is not considered taxable for income tax purposes even though it is provided as part of a ministers overall compensation.

As mentioned in Business Dictionary this is the definition of the housing allowance. If you own your home you may still claim deductions for mortgage interest and real property taxes. If your state law does not exempt parsonages from taxation then there is no point in the pastor transferring title to his home to the church if his only purpose is to avoid paying property taxes.

Pastors are able to opt out of social security if they so wish. From the 15th century to the 19th century most pastors lived in the parsonage a house provided by the church. That means you wont be taxed on necessary work-related housing expenses.

When a pastor moves to be closer to a church their relocation expenses are not tax deductible. If a church withholds FICA taxes for a. If you make arrangements with your church you can elect voluntary withholding.

How Much Do Pastors Make In Alberta Cubetoronto Com

Pastors Parsonage Or Own Home Church Investors Fund

Do Pastors Pay Taxes In Canada Ictsd Org

2014 Pastor S Compensation Benefits

Taxes Archives The Pastor S Wallet

Five Things You Should Know About Pastors Salaries Church Answers

Infographic The Ffrf Is Still Fighting The Us Gov T Over Tax Free Housing Benefits The Gov T Gives To Ministers Of The Gospel Up To 700 000 000 Goes Untaxed Annually Because The Gov T Favors Religion

Humble Advice For The Passive Pastor In The Parsonage Sbc Voices

Do Pastors Pay Taxes In Canada Ictsd Org

The Pastor S Wallet Equipping Pastors To Master Their Personal Finances

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

How Much Do Pastors Make In Alberta Cubetoronto Com

Everything Ministers Clergy Should Know About Their Housing Allowance

How To Set The Pastor S Salary And Benefits Leaders Church

Pastoral Contracts Metropolitan Community Churches

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Long Island In The Region Parting With The Parsonage The New York Times

The Pastor S Wallet Equipping Pastors To Master Their Personal Finances